Problem Statement

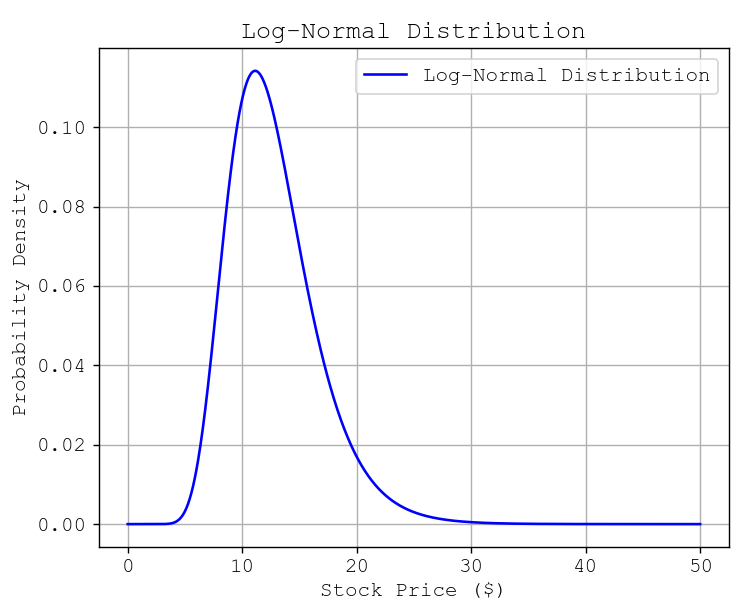

Let's consider stock prices as an example of a log-normal distribution.

Let's consider stock prices as an example of a log-normal distribution.

Suppose the daily returns of a stock follow a normal distribution with:

Since stock prices cannot be negative, the actual stock price follows a log-normal distribution.

Using the log-normal probability formula:

P(X > x) = 1 - Φ((ln(x) - μ) / σ)

For x = 1.5:

Z = (ln(1.5) - 0) / 0.2 ≈ 2.02

From the Z-table, the probability of a value being less than 2.02 is 0.9783.

Thus, the probability of the stock price being greater than 1.5 times the mean:

P(X > 1.5) = 1 - 0.9783 = 0.0217

So, 2.17% of the time, the stock price will be greater than 1.5 times its mean.

The log-normal distribution curve for this example would look like:

📈 Skewed Distribution Representation